MonieWise

Moniewise is a smart budgeting app designed to help users manage their finances effortlessly. By holding users’ money and returning it weekly or monthly, Moniewise ensures they never run out of cash. This case study outlines the design process, challenges faced, and key features implemented.

01

Goals

Enhance User Financial Management: Provide users with a seamless way to budget and manage their finances.

Increase User Engagement: Create an engaging experience that encourages users to interact with the app regularly.

Promote Savings Culture: Help users develop better financial habits through smart budgeting features.

02

Research

User Interviews

Conducted interviews with potential users to understand their pain points with existing budgeting solutions. Key findings included:

Difficulty in tracking expenses.

Inability to save effectively.

Frequent cash shortages before month-end.

Competitive Analysis

Analyzed competitors to identify gaps in the market. Observations highlighted the need for:

Simpler user interfaces.

More engaging budgeting tools.

03

Design Process

Wireframing

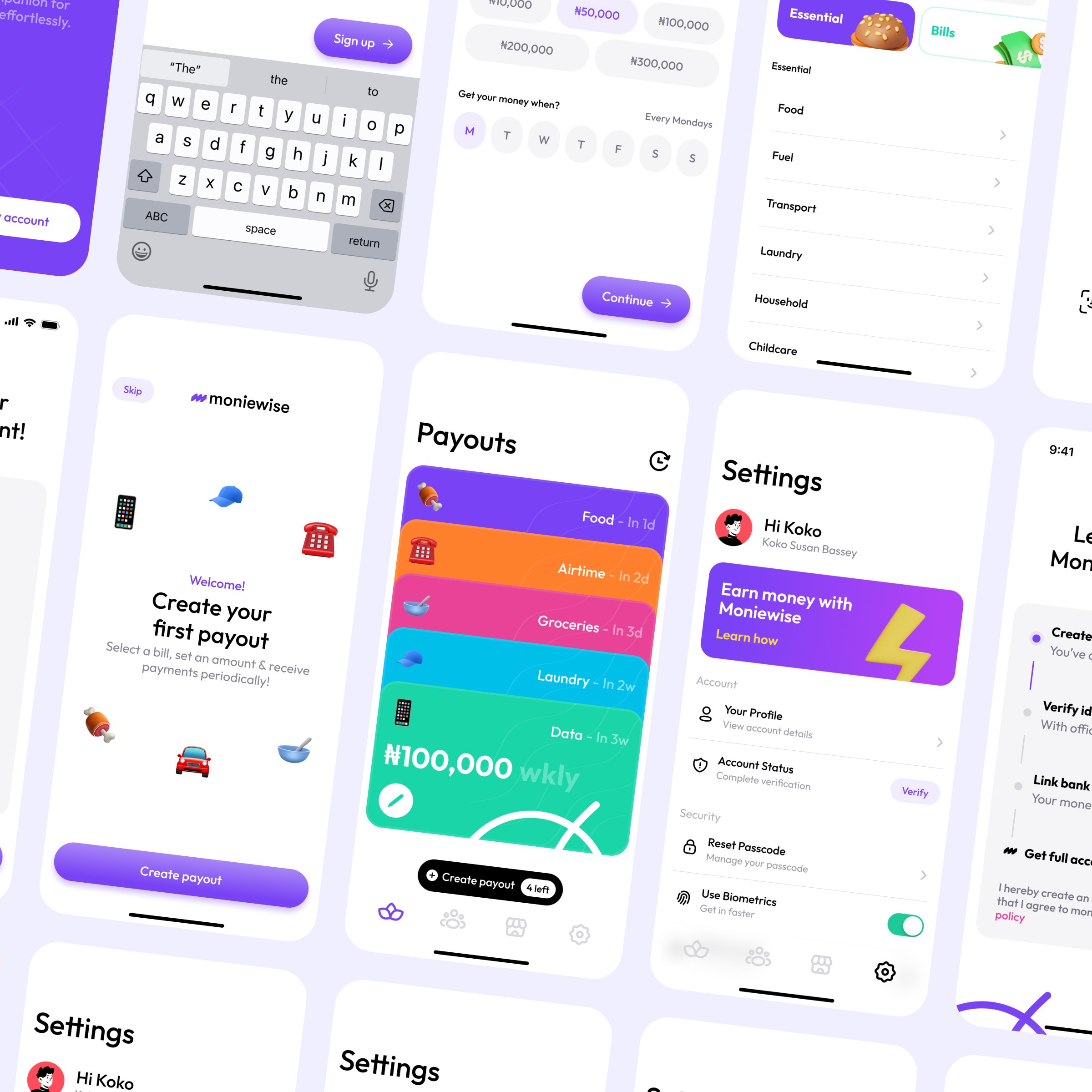

Created low-fidelity wireframes to map out user flows, focusing on key features like:

Payout creation.

Budget tracking.

Allowances for family members.

User Testing

Conducted usability tests with wireframes to gather feedback. Key insights included:

Users appreciated a straightforward interface.

The need for clear guidance on how payouts work.

Visual Design

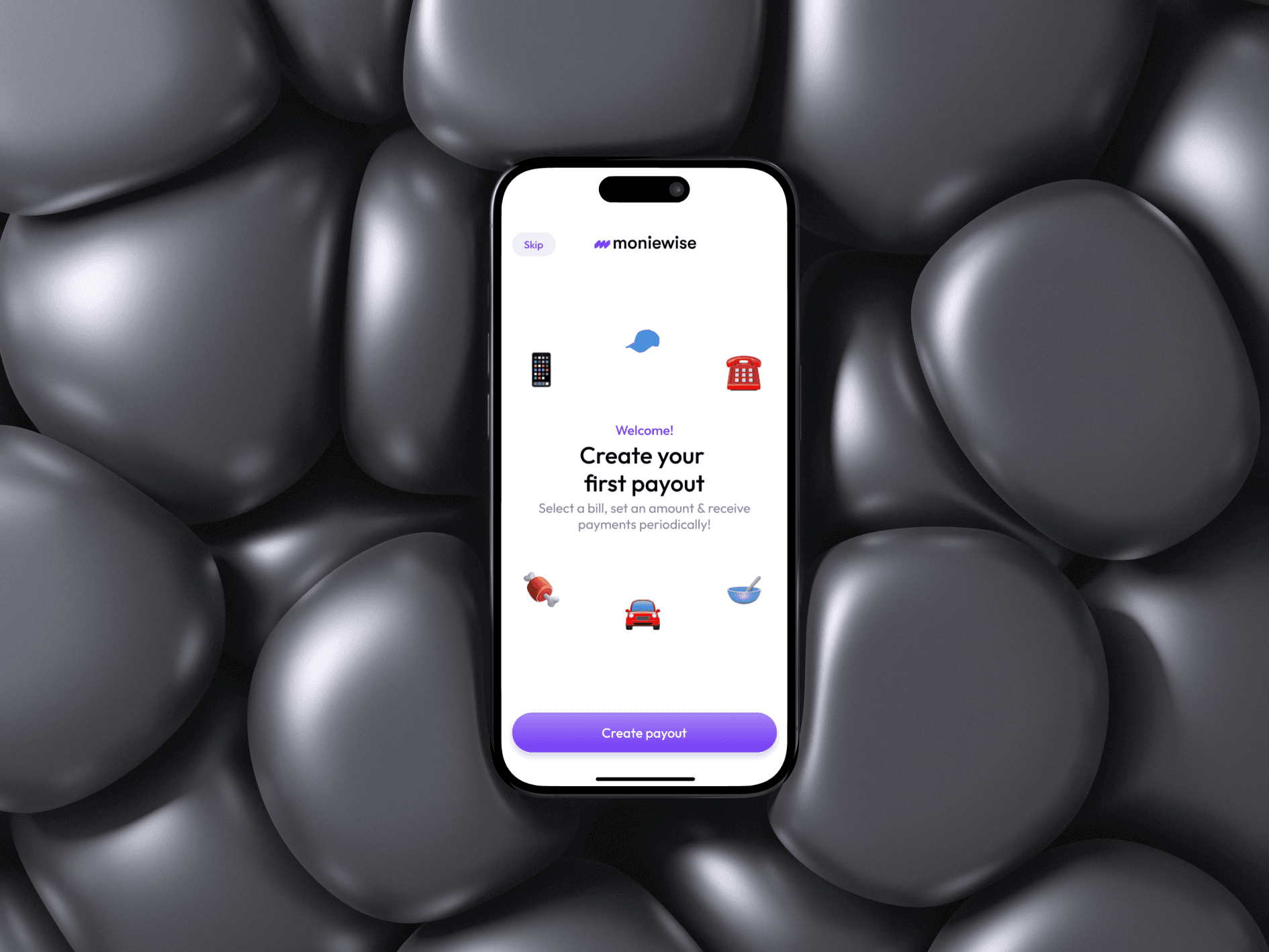

Developed a vibrant and user-friendly UI, incorporating:

A playful color palette.

Intuitive icons.

Engaging animations for a delightful experience.

Key Features

Smart Payouts: Users can set up weekly or monthly payouts to manage their finances effectively.

Allowance Management: Users can allocate funds for family members, ensuring responsible spending.

Store Subscriptions: Users can subscribe to local businesses for essential services, promoting loyalty.

Results

User Feedback: Post-launch feedback indicated a 90% satisfaction rate regarding usability and effectiveness.

Engagement Metrics: User engagement increased by 60% within the first month.

Retention Rate: Retained 85% of users in the first three months after launch.

04

Conclusion

The design of Moniewise effectively addressed user pain points and promoted better financial habits. Continuous user feedback will guide future iterations and feature enhancements to ensure Moniewise remains a vital tool for smart budgeting.

Next Steps

Feature Expansion: Explore additional features like financial goal setting and investment tracking.

Ongoing User Research: Conduct regular surveys to understand evolving user needs.